Strong dram reduces price competitiveness of Armenian exports in international markets

November 01 2024, 13:31

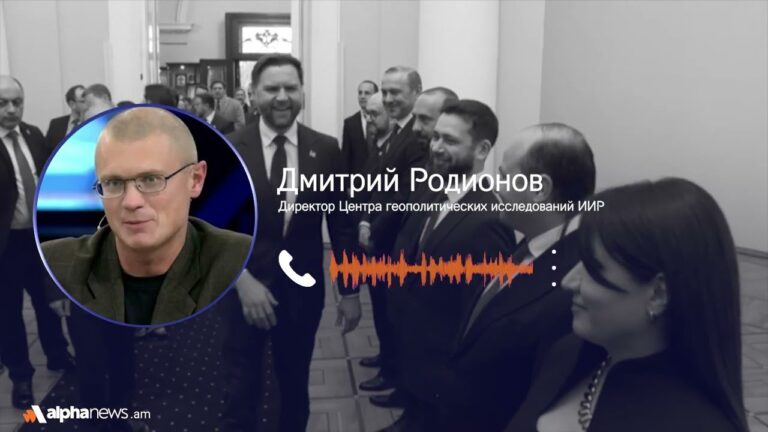

Speaking with Alpha News, Marina Sobolevskaya, Head of the Country Analysis Center of the Research Team of the Eurasian Development Bank, commented on the slow growth of the Armenian economy, the risks, and the bank’s forecasts for the Armenian economy in 2025.

– The figures published by the bank indicate a slowdown in the growth rate of the Armenian economy. What is the reason for this?

In the January-September period, economic activity in Armenia increased by 8.7% year-on-year. This is the highest growth rate of economic activity among the bank’s member countries. These are impressive figures. After record-high growth rates in recent years, in 2022-2023, the economy grew by an average of 10.5%; now economic activity is really gradually slowing down. But we must understand that this is absolutely normal, as the economy is entering a balanced growth trajectory.

The slowdown in the growth rate of the Armenian economy in 2024 is driven, as always, by a number of factors. Some of the factors reflect the current structural change, while others reflect external trends. First, external demand for Armenian goods and services reached record levels in 2022-2023 and is now declining from these peaks. The strengthening of the Armenian dram has also become an additional constraint on exports. The strengthening of the exchange rate reduces the price competitiveness of products in international markets.

Secondly, there is a flow of labor to non-industrial sectors of the economy. The surge in remittances in recent years has contributed to income growth in sectors such as services and trade, and, accordingly, increased the share of employment in low-productivity industries to 14% by mid-2024 from 10% in early 2019. In addition, starting in May 2024, the contribution of industry to economic growth has been declining compared to late 2023 and early 2024. During that period, as we have already written about this, industrial growth was largely due to increased production and foreign trade in precious metals. Perhaps these are the main factors that can be highlighted.

– What risks does the current economic slowdown create for the Armenian economy?

In the absence of new impulses to accelerate growth, the economy will move to more moderate, balanced rates of about 5% per year. We should understand that such growth rates remain quite high and, at the same time, reflect adaptation to the new economic environment. We expect that domestic demand will make the main contribution to the expansion of economic activity, but at the same time, the appreciation of the national currency will have a restraining effect on the export of goods and services. A strong dram reduces the price competitiveness of Armenian exports in international markets, which, accordingly, negatively affects volumes.

– What are the bank’s forecasts for the Armenian economy in 2025? What should we expect?

In early December, we will present an updated macroeconomic forecast, where you can study in detail all the trends and figures that will be related, among other things, to the Armenian economy. But since the question has been asked, I will make a small announcement. We are revising the forecast for the growth of the Armenian economy in 2025 upwards compared to our June macro forecast. Here the main drivers of growth will be consumer and investment demand, which will be supported by a stimulating fiscal policy and lower interest rates.

In addition, the external environment will also have a positive impact, which is important for all our economies. We forecast a revival of economic activity in the eurozone, an acceleration of economic growth in China, and also the preservation of fairly high growth rates in Russia.